CITION CAPITAL AXE

investment strategies

The AXE cutting edge fund offers investors the possibility to get exposure to a number of investments in the tech space, which are almost impossible to get through any other fund. Core of the portfolio is a number of investments in the technological advances blockchain technology offers.

The fund invests in different fields, in which blockchain provides the technological infrastructure of the future and will change the way we pay, we invest and we secure our assets.

Additionally, the fund makes investments into promising listed technology companies. This portfolio constitutes of a broad technology market play, including highly profitably blue chips, specialized market leaders or opportunities in the biotechnology sector

The portfolio is actively managed, meaning there is continuous monitoring of the popular themes and trends in the crypto currency equity space, in depth analysis is done on individual investments. Market timing and fundamental analysis is applied to pick entry and exit points and regular rebalancing and reallocation is conducted on the portfolio level.

general risk management

The fund is suitable for an investor looking to achieve long-term growth of capital, accepting a high degree of risk. Especially the crypto asset component is subject to high volatility, technological risks surrounding the blockchain, hacking risks and others. The fund has a lock-in period during which the investor cannot redeem the fund and subsequently monthly liquidity.

investor risk profile

The fund takes selected risks in the equity and crypto currency space. In order to control risk, the fund is highly diversified in its individual investments, with a maximum position size of 10%. Counterparties such as the custodians are carefully selected and among the industry leaders in Their respective fields. All investments, including locked-up crypto currencies can be redeemed within 90 days at the longest, with 60% of the assets being able to be sold within 30 days.

Head of Asset Allocation GCP Asset Management

Risk Profile

Low

Low to

moderate

Moderate

Moderate to

high

High

General Information

| Domicile | Cayman Islands |

| GCP Asset Management | Cayman Islands |

| Fund Administrator | OM24 |

| Custodian | SBM |

| Auditor | Bakertilly |

| Fund Currency | USD |

| Target Investor | Qualified investor |

| Minimum Investment | 100.000 USD |

| Liquidity | Monthly |

| Valuation | Monthly |

| Isin -Number | KYG2162E1026 |

Fee Structure

| Maximum Initial Charged* | 5% |

| Management fee | 2% |

| Performance fee | 20% |

| High Watermark | YES |

*This represents the advisory fee which may be charge by your intermediary.

contact us

Email: info@citioncapital.com

Website: www.citioncapital.com

TECHNOLOGY THE MOST ATTRACTIVE SECTOR

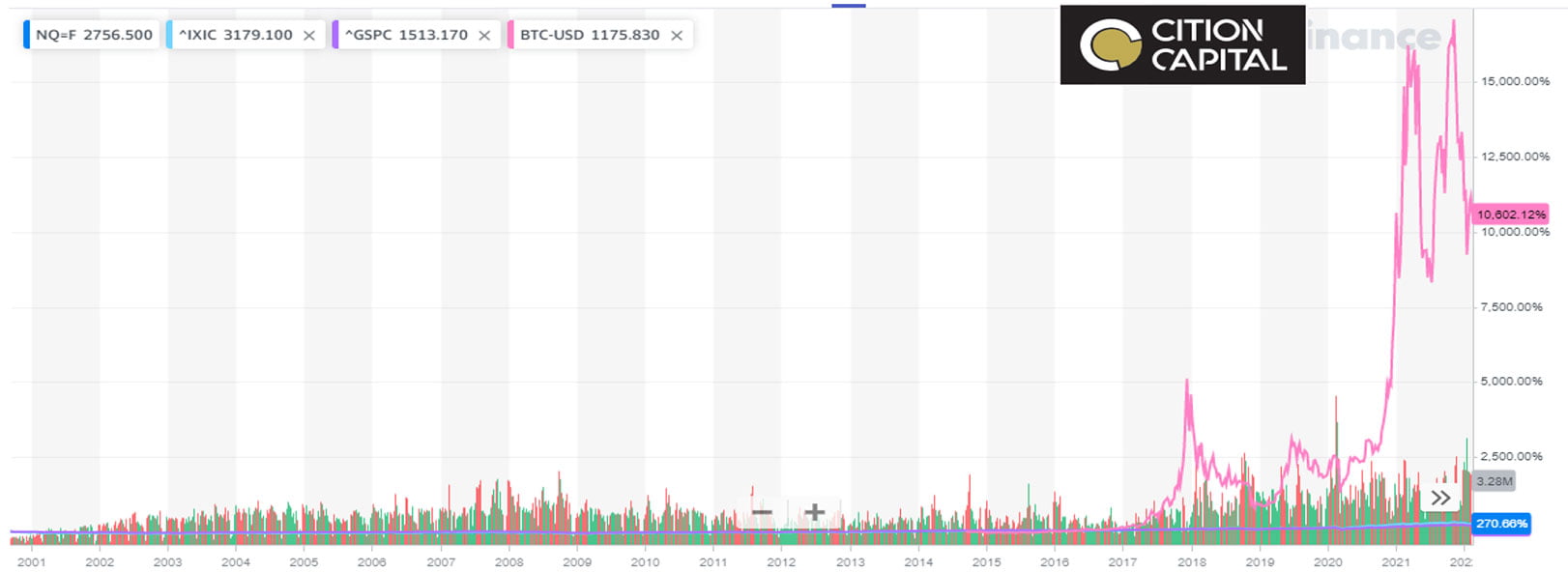

Listed technology companies have outperformed the broader stock market for decades, as represented f.e. by the NASDAQ-100 vs the S&P500. The reason is simple, which is that technology is the most important factor in all industries to drive innovation, growth, increasing efficiency and effectiveness. Autonomous driving in automotive, robotics in production, biotech in healthcare, blockchain in securitization, AI in online marketing, big data in research, are just a few prominent examples proving that the projects and companies that lead in technology are most likely to be successful. Needless to say, such companies also bear the most upside potential.

However, listed companies usually have a lot of the future earnings already priced in and trade at high multiples. Opportunities that bear most of the growth potential are usually pre-IPO Investments, or opportunities in the form of royalties, rights or nowadays in crypto currencies or tokens. Just take a look at the performance of Bitcoin in comparison to the Nasdaq and S&P500. Its performance so far dwarfs any other stock index.

Such investments are not typically accessible through listed investment vehicles. The cumbersome lengthy process to finally list a BTC ETF is just one examples. If the listing of crypto assets on regulated exchanges follows the price development of other stock IPOs, most of the price appreciation will probably have happened in the respective assets before the listing, leaving subsequent investors only standard market growth rates for grabs. Hence, more flexible investment vehicles are necessary to participate in upcoming opportunities as early as possible. This is the opportunity the AXE cutting edge fund offers.

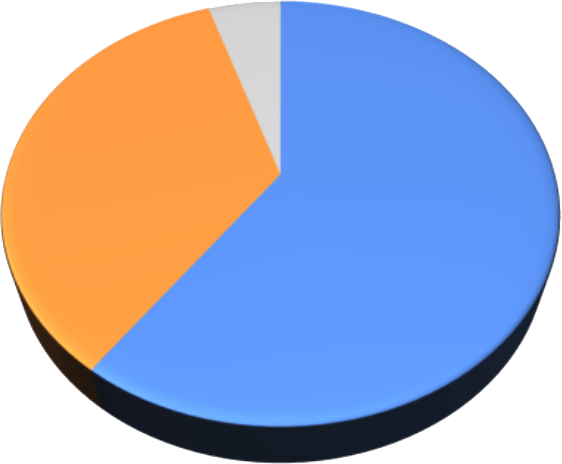

tactical allocation and carry yield

Both portfolio components are flexible in their sizes, but are currently set at 60% blockchain investments and 40% equity investments. As the correlation between both asset classes has historically been low and at times even negative, the equity component reduces the volatility of the blockchain portfolio significantly. Also, returns generated in the crypto market can be ploughed into the stock market and be redeployed to the crypto market, if the crypto market falls and offers attractive entry points.

Tactically, the management makes use of income generating strategies, both in the crypto space, where attractive additional yields can be generated on the side through lending, staking, liquidity mining, etc. and in the equity space where selling covered calls or timing investments around dividend payout dates can generate additional income.

Portfolio Allocation

current portfolio position

blockchain investments

Decentralized Finance

aave

Kava

Ripple

Blockchain platforms and infrastructure:

Ethereum

Solana

Cardano

Store of value (Digital Gold)

Bitcoin

Equity investments

Blue chips

Apple

Microsoft

Amazon

Tesla

Nvidia

Dynamic Market leaders

Zoom

Roblox

Biotechnology sector

Vaxart